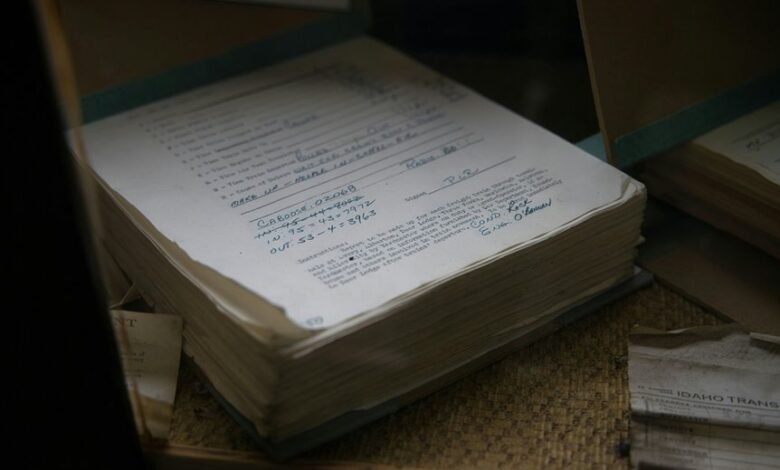

Mastering Bookkeeping Fundamentals 8663566214

"Mastering Bookkeeping Fundamentals" (ISBN: 8663566214) presents a structured approach to fundamental bookkeeping principles. It focuses on essential concepts like ledgers and expense categorization, enabling individuals to enhance their financial management capabilities. The guide also emphasizes regular financial reviews as a means to achieve fiscal independence. However, understanding the intricacies of these practices raises critical questions about their application in real-world scenarios and the potential impact on personal and organizational financial decisions.

Understanding the Basics of Bookkeeping

Bookkeeping serves as the backbone of financial management, providing a structured approach to recording and organizing financial transactions.

Understanding bookkeeping terminology is essential for interpreting financial statements accurately. Key components include ledgers, debits, and credits, which facilitate clear tracking of income and expenses.

Mastery of these concepts empowers individuals to maintain financial independence and make informed decisions regarding their economic well-being.

Key Principles of Financial Management

Effective financial management is critical for the sustainability and growth of any organization, guiding decision-makers in achieving their fiscal objectives.

Key principles include analyzing financial ratios to assess performance and understanding cash flow dynamics to ensure liquidity.

Practical Applications of Bookkeeping Skills

Financial management principles serve as a foundation upon which practical bookkeeping skills can be effectively applied.

Techniques such as account reconciliation ensure accurate financial records, fostering trust and transparency.

Additionally, expense categorization allows businesses to track and analyze spending patterns, enabling informed decision-making.

Tips for Effective Financial Tracking and Reporting

How can businesses enhance their financial tracking and reporting processes to ensure accuracy and efficiency?

Effective expense tracking and meticulous income reporting are critical. Utilizing automated software can streamline data entry and reduce errors.

Regularly reviewing financial statements fosters accountability and transparency. Additionally, establishing a consistent schedule for financial reviews aids in identifying discrepancies, ultimately supporting informed decision-making and promoting fiscal independence.

Conclusion

In conclusion, "Mastering Bookkeeping Fundamentals" equips readers with the knowledge to understand basic concepts, the principles to manage finances effectively, the skills to apply these principles practically, and the strategies to track and report financial data accurately. By embracing these core elements, individuals and organizations can enhance their financial acumen, streamline their record-keeping processes, and ultimately achieve their fiscal objectives. Through diligent application, they can navigate the complexities of bookkeeping with confidence and clarity.